Gifts That Pay You Income

You can fuel the passion for stimulating discourse and friendship while earning an income from your gift.

Charitable Gift Annuities

Charitable Gift Annuities (CGAs) are a great way to support Road Scholar while generating income for yourself and your family, now or for the future. Learn how these gifts allow you to achieve both of these goals.

You can make a substantial impact through Road Scholar while you are receiving tax-favorable income for you and/or a second beneficiary. Many supporters like charitable gift annuities because of their attractive payout rates and their significant impact.

Like a charitable gift annuity, a deferred charitable gift annuity is an irrevocable gift that provides for an immediate charitable deduction and fixed income payments for life for one or two income beneficiaries. Income payments must be deferred at least one year after the gift date.

Benefits to you include the following:

Payments can be made as you prefer on an annual, quarterly or monthly basis.

A portion of the payout will be tax-free.

You receive a charitable tax deduction for a portion of your gift.

Your gift passes to Road Scholar outside of the estate process.

You create a legacy of education to enrich the lives of lifelong learners for years to come.

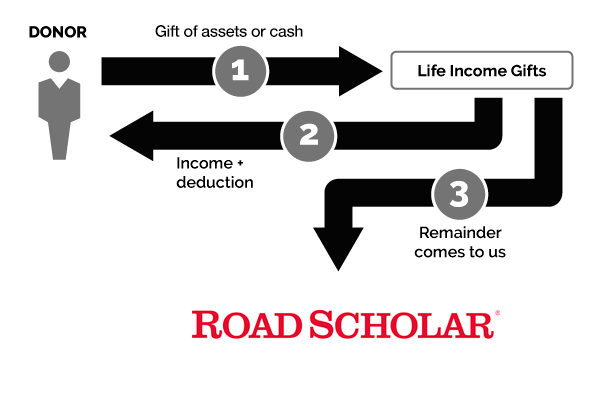

Charitable Remainder Trusts

Charitable remainder trusts provide income for life for you and your family while reducing your taxes and supporting Road Scholar.

By using assets or cash to fund the trust, you receive income and you receive an income tax credit the year in which you transfer your assets. The remaining portion of the trust, after all payments have been made, comes to Road Scholar.

Benefits to you include the following:

You receive income for life for you or your heirs.

You receive a charitable income tax credit for the charitable portion of the trust.

You create a legacy of education to enrich the lives of lifelong learners for years to come.

Our Team is Here to Help

Our experienced team is here to help you…

- Learn about special projects that align with your interests.

- Structure a donation that maximizes benefits for you and your loved ones.

- Stay up to date on how your gift is used.

- And more!