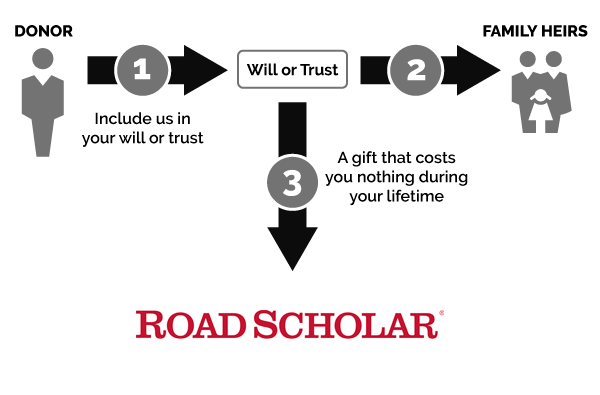

Gifts That Cost You Nothing Now

Gifts in a Will and Gifts by Beneficiary Designation are two easy ways to guide generations of knowledge seekers on transformative learning adventures for generations to come — and they don’t cost anything now.

Gifts in a Will

A gift in your will is one of the easiest ways you can ensure your legacy of enriching the lives of lifelong learners.

No Cost

Costs you nothing now to give in this way.

Flexible

You can alter your gift or change your mind at any time and for any reason.

Lasting Impact

Your gift will create your legacy of educational travel experiences.

4 simple, “no-cost-now” ways to give in your will:

General Gift

Leaves a gift of a stated sum of money in your will or living trust. For example, you might decide to leave each of your grandchildren $10,000. It’s considered to be ‘general’ because it doesn’t specify from where the money comes.

Residual Gift

Leaves what is left over after all other debts, taxes and other expenses have been paid.

Specific Gift

Leaves a specific dollar amount, percentage, fraction or specific items (collections, art, books, jewelry and so on).

Contingent Gift

Leaves a stated amount or share only if a spouse, family member or other heir/beneficiary does not live longer than you. In other words, your gift is contingent upon whether or not they survive after you.

“Seeing the Northern Lights and the ceiling of the Sistine Chapel with Road Scholar were lifelong dreams of mine. Naming the organization in my will is a way to say thank you and help assure that the kinds of experiences I’ve cherished are around for years to come.”

— Elaine G., Road Scholar Donor —

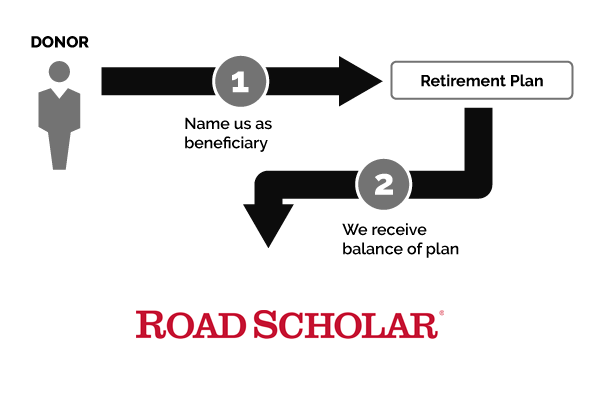

Gifts by Beneficiary Designation

It’s easy to put your bank accounts, retirement funds, savings bonds, and more to use in creating opportunities for adult learners — and it costs nothing now.

By naming Road Scholar as a beneficiary of these assets, you provide opportunities for older adults to learn, feel reinvigorated, meet new friends and expand their horizons. Your gift will leave a legacy of education to enrich the lives of older adults for years to come.

(click infographic to enlarge)

Potential benefits of gifts by beneficiary designation:

Reduce or eliminate taxes on retirement assets

Reduce or avoid probate fees

No cost to you now to give

Create your legacy with Road Scholar

To name Road Scholar as a beneficiary of your retirement plan, contact your bank or insurance company to see whether a change of beneficiary form must be completed.

How to Change a Beneficiary Designation:

Login to your account or request a Change of Beneficiary Form from your custodian (the business holding your money or assets).

Follow the links to change your beneficiary or fill out the form.

Be sure to spell the name of our organization properly: Road Scholar or Elderhostel, Inc.

Include our tax identification number: 04-2632526

Save or submit your information online or return your Change of Beneficiary Form.

Types of Gifts:

A gift of retirement funds (beneficiary of your retirement plan)

You can simply name Road Scholar as a beneficiary of your retirement plan to support older adults looking for a transformative educational travel experience.

A gift of funds remaining in your bank accounts, brokerage accounts or certificate of deposit (CD)

This is one of the easiest gifts to give and one of the most useful in accomplishing what you want – supporting the pursuit of lifelong learning. The next time you visit your bank, you can name Road Scholar (Tax ID: 04-2632526) as the beneficiary of a checking or savings bank account, a certificate of deposit (CD), or a brokerage account. When you do, you’ll take a powerful step toward educating lifelong learners for generations to come.

Donor-advised fund (DAF) residuals

What remains in a Donor-Advised Fund is governed by the contract you completed when you created your fund. When you name Road Scholar as a “successor” of your account or a portion of your account value, you are supporting deep and life-changing educational opportunities for participants from all walks of life.

Life insurance

You can name Road Scholar as a beneficiary of all or a portion of your life insurance policy. With this gift arrangement, Road Scholar will receive the proceeds of your policy after your lifetime. You can change your beneficiary at any time.

This gift is easy to arrange — simply request a beneficiary designation form from your plan administrator.

Savings bonds

If you have bonds that have stopped earning interest and you plan to redeem them, you might owe income tax on the appreciation. That could result in your heirs receiving only a fraction of the value of the bonds in which you invested. Since Road Scholar is a tax-exempt institution, naming us as a beneficiary means that 100% of your gift will go toward inspiring older adults to learn, discover and travel.

Our Team is Here to Help

Our experienced team is here to help you…

- Learn about special projects that align with your interests.

- Structure a donation that maximizes benefits for you and your loved ones.

- Stay up to date on how your gift is used.

- And more!